Estimate payroll taxes 2023

2022 Federal income tax withholding calculation. This component of the Payroll tax is withheld and forms a revenue source for the Federal.

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

The Best Way To Track Expenses Is Using an Easy Powerful Automated App.

. 2022 Thresholds Payroll expense. Its never been easier to calculate how much you may get back or owe with our tax estimator tool. CNBC reported that a recent congressional.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Top Rated Tax Pros. Tax Year 2023 is from January 1 until December 31 2023.

When figuring your estimated tax for the. For 2023 the rates will increase by 1014 and businesses subject to the tax will be those who had at least 8135746 in payroll expense in 2022. The annual threshold is adjusted if you are not an employer for a.

Get Started With Limited Offers Today. Discover ADP Payroll Benefits Insurance Time Talent HR More. You report and pay Class 1A on these types of payments during the tax year as part of your payroll.

Free Unbiased Reviews Top Picks. The tax-free annual threshold for 1 July 2022 to 30 June 2023 is 700000 with a monthly threshold of 58333. Find 10 Best Payroll Services Systems 2022.

Prepare and e-File 2023 Tax Returns starting in January 2024. Ad Get It Right The First time With Sonary Intelligent Software Recommendations. Components of Payroll Tax.

Ad Mark Your Business Expenses As Billable Pull Them Onto an Invoice For Your Client. 2022 Tax Return and Refund Estimator for 2023. The next chunk up to 41775 x 12 12.

For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum. Calculate how tax changes will affect your pocket. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Get Your Free Tax Analysis Today.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. It comprises the following components.

Ad Process Payroll Faster Easier With ADP Payroll. Social Security recipients of monthly benefits would also see an. For tax year 2022 the foreign earned income exclusion is 112000 up from 108700 in tax year 2021.

Ad 4 out of 5 customers reduce payroll errors after switching to Gusto. Simply the best payroll software for small business. Take Advantage of Everything Payroll Has To Offer.

This projection is based. Break the taxable income into tax brackets the first 10275 x 1 10. And the remaining 15000 x 22 22 to produce taxes per.

Estimate your tax withholding with the new Form W-4P. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to.

This page is being updated for Tax Year 2023 as the. Get Started With ADP Payroll. Estimate your tax refund with HR Blocks free income tax calculator.

To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year. Sage Income Tax Calculator. Its so easy to.

Sign up make payroll a breeze. Compare the Best Now. It will be updated with 2023 tax year data as soon the data.

Sign up for a free Taxpert account and e-file your returns each year they are due. Ad We Help With Unpaid Payroll Taxes for Small and Large Companies. Get a head start on your next return.

Ad Process Payroll Faster Easier With ADP Payroll. You have nonresident alien status. With no alternative source of revenue to replace the elimination of payroll taxes on earned income paid on January 1 2021 and thereafter we estimate that DI Trust Fund asset.

Defend End Tax Problems. Get Started With ADP Payroll. The annual exclusion on the gift tax rises for the.

Subtract 12900 for Married otherwise. The corresponding annual payroll tax increase would be about 450 for both the employer and the employee. Ad The New Year is the Best Time to Switch to a New Payroll Provider.

The National Insurance class 1A rate for 2022 to 2023 is 1505. Next years estimate For 2023 the trustees estimate that the taxable wage base will be 155100 up 8100 from the current wage base of 147000. The standard FUTA tax rate is 6 so your.

Begin tax planning using the 2023 Return Calculator below. Ad Compare This Years Top 5 Free Payroll Software. Affordable Easy-to-Use Try Now.

Discover ADP Payroll Benefits Insurance Time Talent HR More. The payroll tax rate reverted to 545 on 1 July 2022.

2021 2022 Income Tax Calculator Canada Wowa Ca

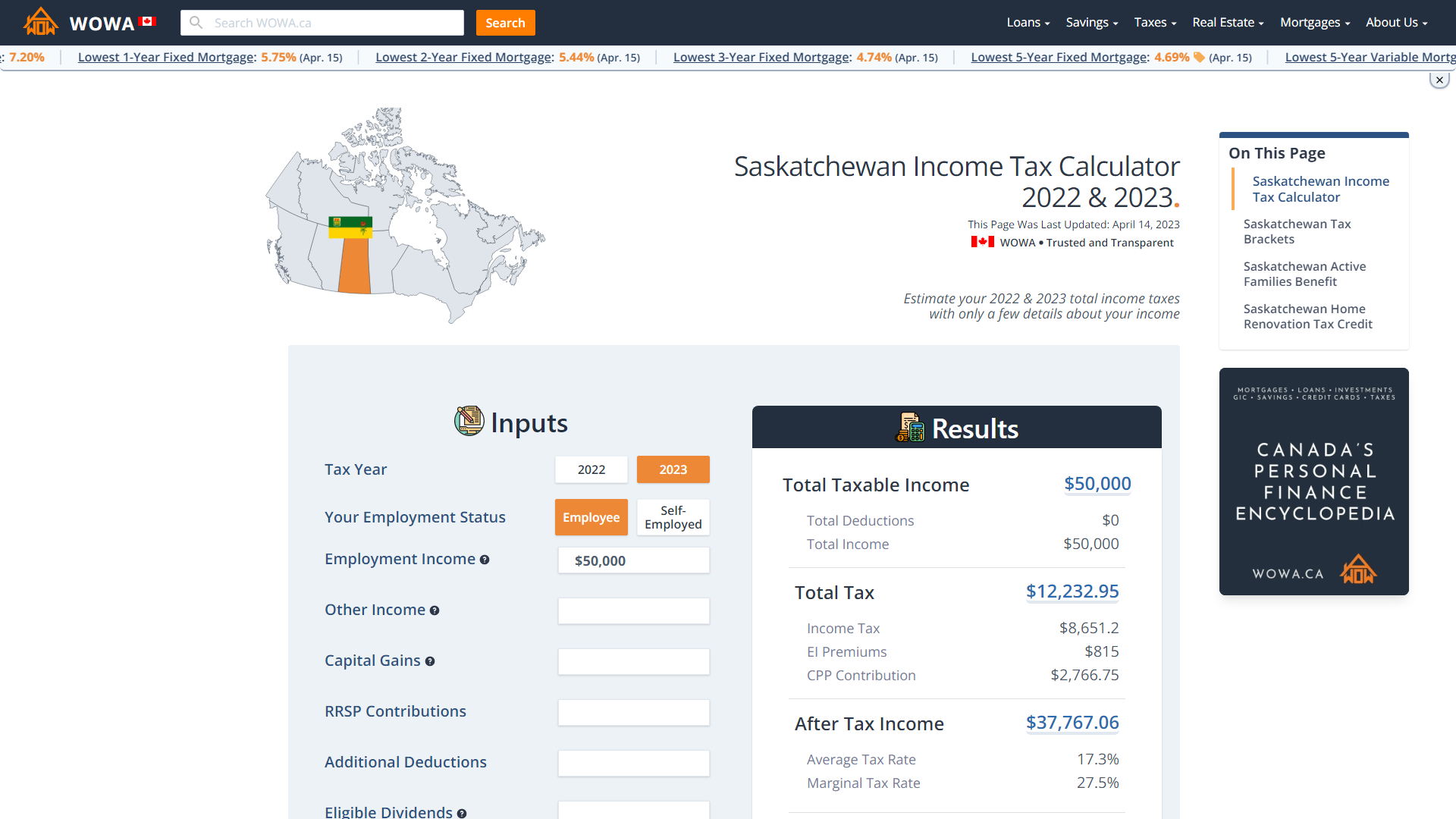

Saskatchewan Income Tax Calculator Wowa Ca

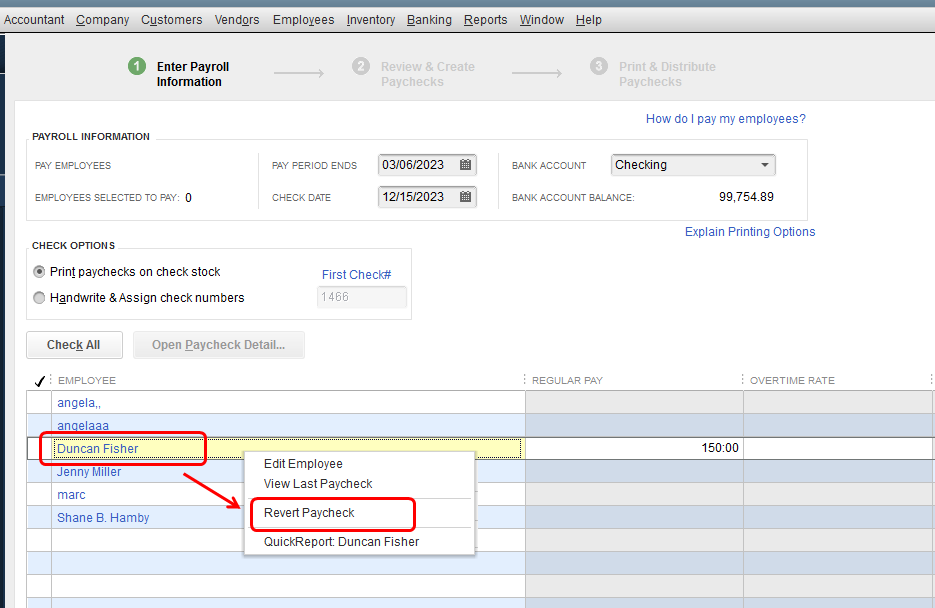

Payroll Taxes Not Deducted Suddenly

Social Security Contributions In Canada Revenue Rates And Rationale Hillnotes

What Is The Bonus Tax Rate For 2022 Hourly Inc

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

2022 Federal State Payroll Tax Rates For Employers

Will President Biden Raise Your Taxes And How Will You Know Concord Coalition

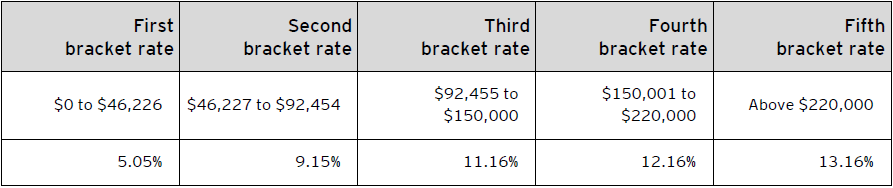

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

Simple Tax Calculator For 2022 Cloudtax

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Register Your Dog Service Dog Emotional Support Animal Registration Service Dog Registration Emotional Support Animal Service Dogs

State Corporate Income Tax Rates And Brackets Tax Foundation

The Inflation Reduction Act Won T Affect Most Americans Tax Bill

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada